Nelnet (NYSE: NNI)

Company: Nelnet

Market Cap: 2.87B

P/E: 8.2x (LTM) / 11.3x (NTM)

Share Price: ~$74

Tangible Book/Share: $63

Brief History:

Nelnet is a company formed in Nebraska in 1978 to service federal student loans for two local banks. Since then, the company quickly grew to become a leading originator and servicer of student loans, primarily of those that originated under the Federal Family Education Loan Program (FFELP). Starting in 1965, FFELP was a system under which loans originated by banks and other private lenders were guaranteed by the US federal government. However, the Reconciliation Act of 2010 discontinued the creation of new loans by private lenders and shifted all future originations to the Department of Education (DOE) under the Direct Loan program, effective July 2010. This meant that Nelnet’s legacy business of originating FFELP loans came under threat. Since then, the company's survival mechanism has been to acquire portfolios of FFELP loans (~$28billion to date) from various third parties exiting or adjusting their FFELP businesses and to diversify its income stream as its loan portfolio gradually winds down.

Nelnet’s Operating Segments:

Nelnet is broken down into four* operating segments: Asset Generation Management (AGM), Loan Servicing and Systems (referred to as Nelnet Diversified Services), Education Technology, Services, and Payment Processing (referred to as Nelnet Business Services), and Nelnet Bank which I won’t speak on as it’s a fairly new segment.

*The latest fillings will report five operating segments including Communications, but on October 2020, Nelnet entered into an agreement with SDC Allo Holdings whereby SDC invested $197million into ALLO (then a majority-owned communication subsidiary of Nelnet) for a 48% ownership stake, valuing ALLO at roughly $400million. Nelnet remains a 45% owner of ALLO and as a result of the recapitalization, the company will de-consolidate ALLO’s operating results from its consolidated financial statements, recording a total of $361million in investment on its balance sheet. $258.6million was realized as gains in 2020 from this de-consolidation.

1. Asset Generation and Management

As mentioned above, Nelnet manages a portfolio of federally insured student loans. Since the discontinuation of the FFEL program in 2010, the company has sustained cash flows in this operating segment primarily by acquiring portfolios of FFELP loans from third-party entities. The company’s loan portfolio also includes private education and consumer loans but these loans only account for ~3% of the portfolio. Nelnet funds its student loan portfolio in asset-backed securitization. The company earns roughly 1.5% in net interest income from its portfolio and has been a beneficiary of decreasing interest rates as it’s been able to fund its fixed-rate student loans at lower rates. This, however, has been realized on a decreasing student loan portfolio.

As of December 31, 2020, Nelnet carried roughly $19.6billion in loans, of which $19.1billion is federally insured student loans. The discounted cash flows* one could expect from the company’s current portfolio (assuming no further loan acquisition and an aggressive 10% repayment over time) is roughly $2billion.

* Cash flows are discounted at 3% inflation due to their insignificant risk (federally insured loans are 97-100% covered).

Adding that to the current ~$1.5billion in tangible book value (excludes ~ $733million in restricted cash assets) yields a fair book value of $3.5billion, a 25% premium to the current market price. A 25% upside (roughly estimated) perhaps isn’t all that attractive considering the due diligence costs incurred from evaluating a more exact number. In addition, Nelnet (NYSE: NNI) is a 16.8million float stock, slippage resulting from transacting such an illiquid stock quickly eats through the upside. However, there’s much to Nelnet than its traditional business of originating and servicing a portfolio of student loans, and as you’ll later see, the company has positioned itself well in transitioning out of its interest income-earning operations.

2. Loan Servicing and Systems

To service the large volume of student loans now originated under the Direct Loan Program, the DOE, in 2009, awarded servicing contracts to four private sector companies (referred to as Title IV Additional Servicers or TIVAS) - FedLoan Servicing (PHEAA), Great Lakes Educational Loan Services (acquired by Nelnet in 2018), Navient, Nelnet - and five not-for-profits (NFP) entities - CornerStone, HESC/Edfinancial, Granite State/GSMR, MOHELA, OSLA. Allocation of student loan volumes is determined twice a year and is based on the performance of each servicer (i.e. how well they helped borrowers avoid defaults, how well the servicers worked with DOE's staff members, etc...). The latest publicly announced performance ranks Great Lakes and Nelnet in first and tied for fifth place, respectively. As a result, for the period of September 1st, 2020, through February 28, 2021, Great Lakes was awarded 20% of total student loan volume and Nelnet 10% for a combined total of 30% of student loan volume, the highest among all nine servicers.1

Loan servicing activities require systems that provide automated compliance with federal student loan regulations. Among the loan servicing activities performed by the company are loan conversion activities, application processing, borrower updates, customer service, payment processing, back-up servicing, software technology services, and claim processing. The company earns a monthly fee from the Department of Education on a per borrower basis. This fee is dependent on the status of the borrower (in school vs. in repayment). This segment of Nelnet’s operations relies on established infrastructure and technology, allowing the company to also service FFELP student loans for third-party entities for a fee.

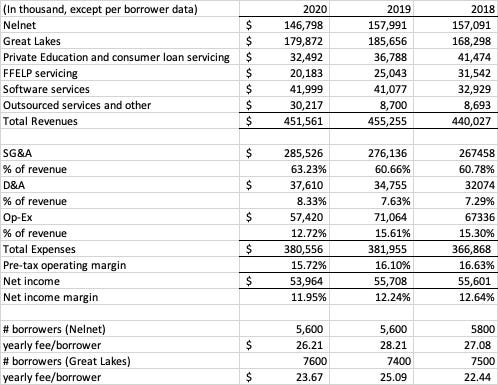

Following the 2010 ruling for the Direct Loan Program, the federal student loan servicing industry began to consolidate. Many lenders exited the business, selling their FFELP student loan portfolios to companies like Nelnet who have the infrastructure to service large volumes. In 2018, Nelnet acquired Great Lakes, taking on a larger portfolio of student loans and greater capacity to service borrowers. The Loan Servicing and Systems segment generated about $54million in net income on ~$450million in revenues in 2020 (~12% net income margin).

Figure 1. Loan Servicing and Systems Operating Results 2018-2020

Now that we’ve covered two-thirds of Nelnet’s main operations, here comes the opportunity:

3. Education Technology, Services, and Payment Processing

The majority of the company’s customers are located in the US but Nelnet also services some schools internationally, primarily in Australia, New Zealand, and Southeast Asia. According to a 2018 survey by the Institution of Education Science, a statistical, research, and evaluation arm of the US DOE, there are ~32,500 private K-12 schools in the United States, of which ~42% are faith-based.2 With a little under 40% market share of a fragmented private K-12 tuition and financial management sector, FACTS continues to grow by way of introducing new products (student information systems and several education solutions) to existing customers and acquiring financial management companies servicing cohorts of K-12 and higher education institutions. This entire segment of Nelnet (reported as Nelnet Business Solutions) earned a Net Promoter Score of 813, emphasizing the excellent customer service Nelnet provides to its customers. The company’s competitive positioning continues to strengthen as it works to integrate its technologies with that of customers’ existing third-party services, and continues to onboard customers to its platform by consolidating smaller players.

Assessment of the Opportunity:

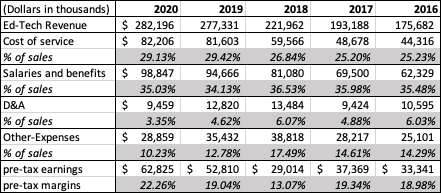

Since 2016, Nelnet’s Education Technology Services and Payment Processing segment has compounded top line at 12% a year, generating roughly $63million in pre-tax earnings from $282million in revenue, a 22% pre-tax margin (Figure 2). With such growth rates and attractive margins, a reasonable 15x multiple on TTM pre-tax earning yields a value north of $900-$1billion or $26 per share. Combined with the $93 fair book value per share identified above, Nelnet’s stock is worth north of $120, and this is without accounting for future earnings growth.

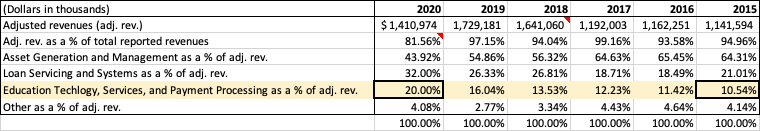

Such value is not reflected at all in today’s market price and I believe this provides an attractive opportunity for long-term shareholders willing to ride out the melting ice-cube that is the company’s student loan portfolio and allow the company’s Education Technology, Services, and Payment Processing segment becomes an increasingly larger portion of total revenues (Figure 3).

Figure 2. Education Technology, Services, and Payment Processing segment results (excludes interest earned on tuition held in custody for schools)

Figure 3. Nelnet’s operating segment revenue breakdown (adjusted revenue excludes non-core operating items such as gains/loss from derivative settlements, proceed from sale of loans, and gain from deconsolidation of ALLO in 2020)

Nelnet Shareholder Meeting - May 22, 2020

Comments

Post a Comment